The Single Strategy To Use For Ach Processing

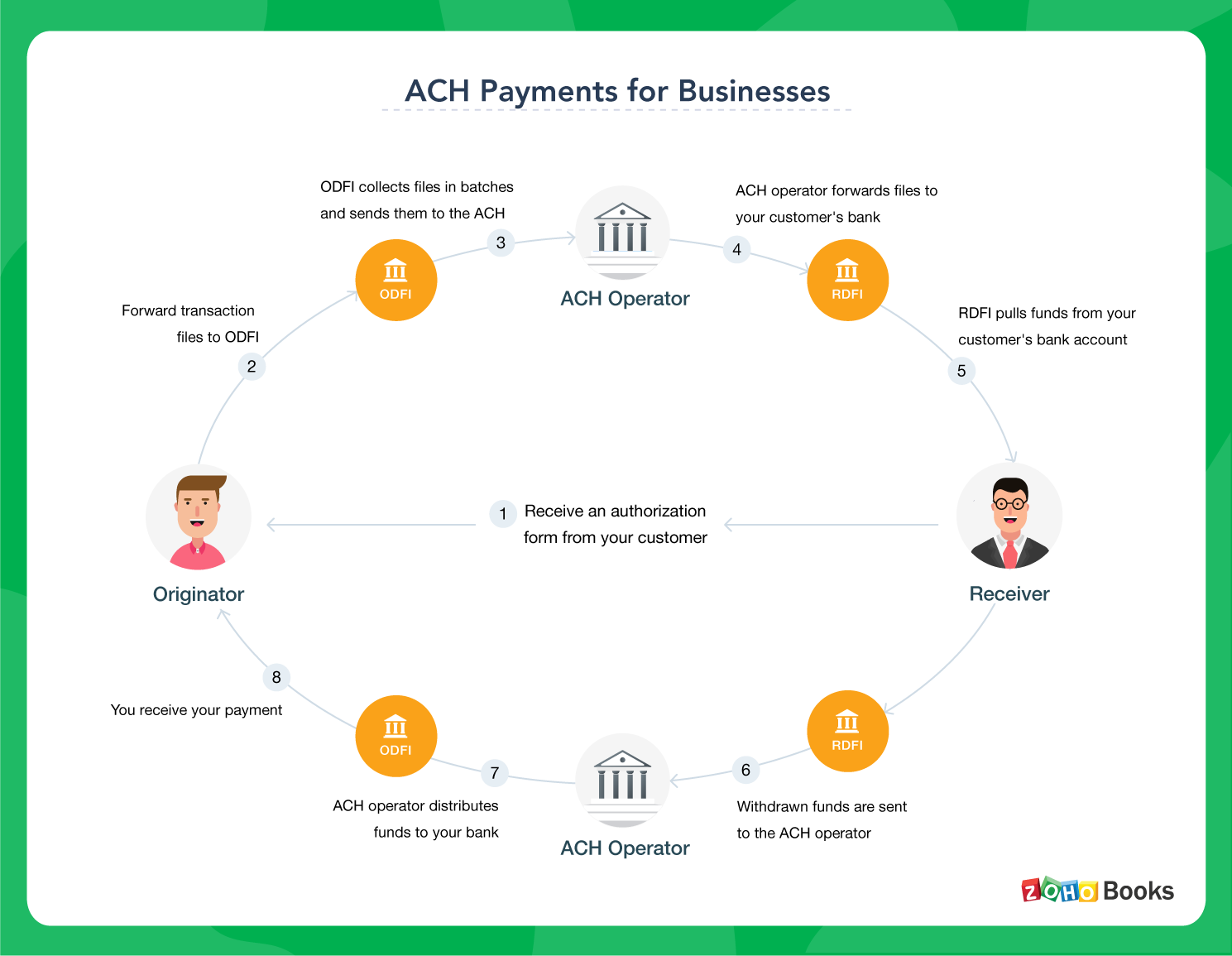

Throughout the years, the world of financial has actually customized radically and also has actually around the world influenced countless people. During this age of advancement, rather than paying by cash, checks, credit or debit card, the settlement procedure has progressed into quicker, safer as well as extra effective digital approaches of transferring money. Automated Cleaning Home (ACH) has actually made this feasible.

There are 2 primary categories for which both consumers and also companies make use of an ACH transfer. Straight payments (ACH debit deals) Direct down payments (ACH credit score transactions) Some financial establishments also use costs payment, which enables customers to set up as well as pay all expenses online making use of ACH transfers. Or you can utilize the network to launch ACH purchases in between individuals or merchants abroad.

Usually, ACH transfers clear the financial institution in just a few company days unless there are not enough funds in the account. However, deals can take longer under certain circumstancessuch as if the system spots a possibly fraudulent purchase. An ACH repayment is made through the ACH network, as opposed to experiencing the significant card networks like Visa or Mastercard. ach processing.

Ach Processing Can Be Fun For Everyone

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)

An ACH debit deal does not entail physical paper checks or debit card. ach processing. The only details the payee needs is a savings account and also routing number. To launch a transaction with ACH, you'll require to license your biller, such as your electrical business, to pull funds from your account. This usually happens after you offer your bank account and also transmitting numbers for your savings account and also provide your authorization by either physically or digitally signing an agreement with your biller.

You can also set up a link between your biller as well as your financial institution account without authorizing automatic repayments. This gives you higher control of your account, enabling you to transfer repayment funds just when you especially allow it.

It relocates cash from the company's bank account to a worker's in an easy and relatively inexpensive way. The employer merely asks their banks (or payroll firm) to advise the ACH network to pull cash from their website here account and also down payment it accordingly. ACH deposits enable individuals to launch deposits elsewherebe that a bill payment or a peer-to-peer transfer to a buddy or property owner.

Ach Processing Fundamentals Explained

An ACH direct settlement delivers funds right into a bank account as credit. When you receive settlements through direct down payment with ACH, the advantages consist of benefit, less costs, no paper checks, and quicker tax refunds.

Photo source: The Equilibrium The number of debit or ACH credit scores processed each year is gradually boosting. In 2020, the ACH network processed financial deals worth even more than $61. 9 trillion, a rise of virtually 11 percent from the previous year. These included government, consumer, and business-to-business deals, as well as worldwide settlements.

The 5. 3 billion B2B paymentsvalued at $50 trillionreflect a 20. 4% increase from 2020, as the pandemic fast-tracked companies' switch to ACH settlements. Over just the have a peek at this website past 2 years, ACH B2B repayments are up 33. 2%. An ACH credit report involves ACH transfers where funds are pressed right into a bank account.

For instance, when a person establishes up a settlements through their financial institution or cooperative credit union to pay bills from their chosen checking account, these payments would be refined as ACH credits. ACH debit deals involve ACH transfers where funds are pulled from a checking account. That is, the payer, or client provides the payee authorization to complete repayments from their nominated savings account whenever it becomes due.

6 Easy Facts About Ach Processing Explained

ACH and credit card payments both allow you to take recurring settlements just and conveniently. However, there are 3 main distinctions that it may be valuable to highlight: the assurance of settlement, automated cleaning residence processing times, as well as costs. When it involves ACH vs. bank card, one of the most important distinction is the warranty of payment.

Comments on “Indicators on Ach Processing You Should Know”